Steven Jessen-Howard, JD Anticipated May 2023, Law & Public Policy Scholar

As of 2019, nearly 11 million children in the United States were poor. Most of the world’s advanced economies have policies such as paid family leave, free or significantly discounted child care, and “child allowances” (regular cash payments to parents), but the United States has long lagged behind those countries in family support policies. While the U.S. provides a Child Tax Credit (CTC) for parents, historically, its value has not approached the costs of raising children, and its structure excluded the poorest parents.

The passage of the American Rescue Plan (ARP) shortly after President Biden took office offered a potential paradigm shift in America’s approach to fighting child poverty. The bill included a one-year provision that expanded the size of the CTC and allowed parents with zero or little income to qualify for the full amount of the credit. Researchers estimated that those changes to the CTC lifted nearly 4 million children out of poverty, an estimated 75,000 of whom lived in Philadelphia. Along with an expansion of the Earned Income Tax Credit (EITC), these benefits, if continued, would put more than $1 billion in Philadelphians’ pockets annually. That amount totals nearly one-fifth of the City’s entire budget.

Despite the immense benefits that it has provided to millions of families, the CTC has not fully lived up to its potential. Because it is administered through the IRS, low-income families who do not have to file taxes (non-filers) did not automatically receive their CTC payments. Instead, they had to use an online portal to fill out their information and establish that they should receive the credit. Many families were unaware that the credit existed or that they were newly eligible to receive it. Others struggled to claim their benefits because they lacked internet access or faced language barriers.

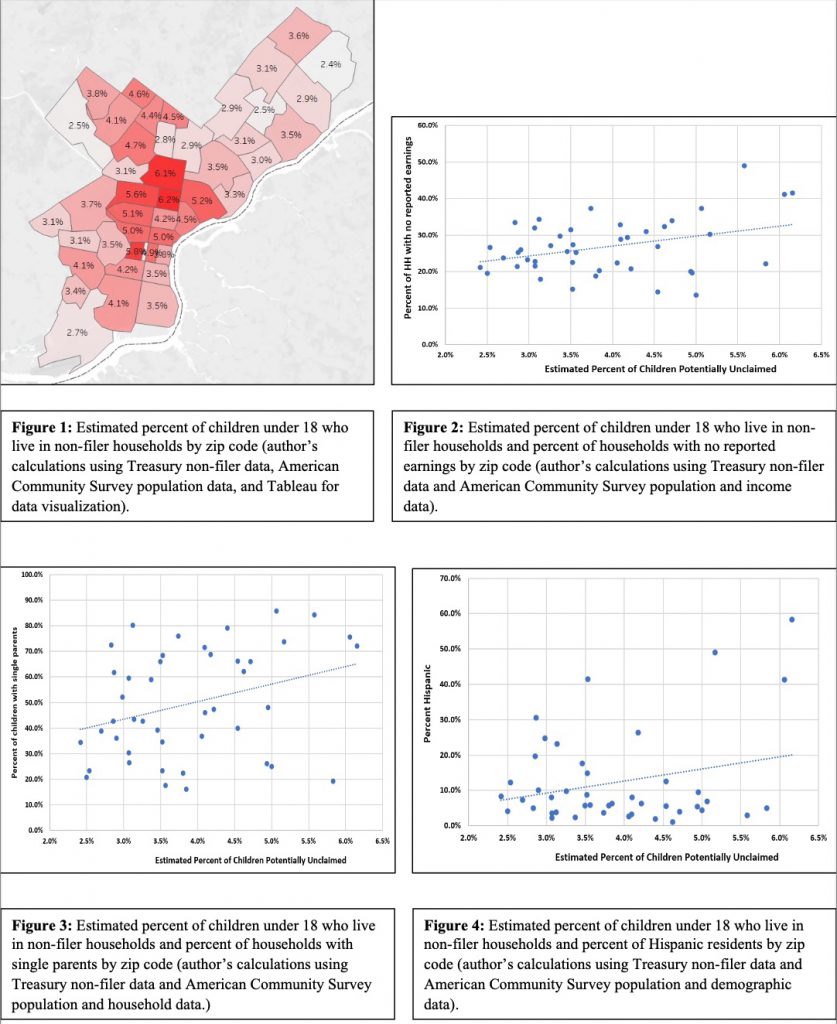

Therefore, households who do not typically file taxes but are eligible for the credit have been most at-risk of not receiving the credit. Zip-code data indicates which parts of Philadelphia are disproportionately impacted, with North Philadelphia having the greatest proportion of eligible non-filers. Philadelphia zip codes with higher proportions of low-income families, single parents, and Hispanic residents tended to have more families at-risk of not receiving their CTC benefits.

Recognizing the importance of the credit to the well-being of their children and families, many cities launched efforts to help their residents access CTC benefits. Philadelphia was one of the leaders in this effort. Without specific federal data about who was eligible but not receiving the CTC to guide them, the City began contacting at-risk families to inform them about the credit and help them receive it. As of early November 2021, the City had called 22,000 people and texted 37,000 more. The City has also worked with non-profit organizations, such as the Campaign for Working Families and Community Legal Services, to get the word out. They have hosted CTC information sessions and sign-up opportunities at community events to help eligible families access their benefits. This outreach has made a significant impact, helping around 1,600 families receive thousands of dollars in benefits they would have otherwise overlooked. Nonetheless, thousands more are likely missing out, and statewide survey results indicate that the number of eligible families who aren’t receiving the CTC could far exceed just non-filers.

As tax season approached, efforts shifted to encourage low-income families, many of whom do not typically need to file taxes, to do so this year to ensure they receive their benefits. The City has provided $192,000 in grants to 17 community organizations to encourage and assist with tax filing. That investment could pay off, as 10,000+ families could leave more than $30 million total in unclaimed CTC benefits on the table if they don’t file taxes.

Philadelphia’s CTC outreach efforts illustrate both how cities can help low-income families access needed benefits and the limits of what they can accomplish without federal action. The City cannot change the CTC’s implementation structure on its own. In December, Philadelphia Mayor Jim Kenney joined more than 50 mayors in a letter to Congress calling on legislators to extend the expanded CTC. However, the one-year expansion of the CTC expired at the end of 2021, and Congress appears increasingly unlikely to pass an extension. In the first month without the expanded CTC, the child poverty rate rose by 41%, putting nearly 4 million children back into poverty.

To avoid further losing the progress that the expanded CTC has made for kids in Philadelphia and beyond, Congress must extend the expanded CTC benefits, and should do so in a way that makes it easier for families in need to access them. The Biden Administration has taken several steps to promote access, including adopting a more accessible online tool to register for CTC benefits and signing an executive order that seeks to streamline government service provision and create “new online tax credit eligibility tools.” Congress should build on those improvements. Legislators could require the IRS to work with the Social Security Administration and state benefit agencies to identify eligible families and deliver payments automatically. Or, they could rewrite eligibility rules to ensure that children who live with a caregiver other than a parent or who have recently begun living with a new caregiver still receive timely payments.

Rather than excluding children in higher-income families, Congress should also consider making the CTC universal. This change would remove the burden on families to prove that their income level makes them eligible for the CTC, simplifying the process, and reducing the number of families who miss out on needed support for administrative reasons. While richer families can get by without the CTC, the cost of this expansion would be minimal given how few higher-income families are currently excluded. And that cost can be made up for by financing the CTC and other child and family support policies through raising taxes on the wealthiest individuals, as the Biden Administration has proposed.

City governments have an important role to play in helping their residents access federal support. However, they can only play with the hand they’re dealt. Philadelphia has made admirable outreach efforts to help marginalized residents access vital funds. Still, thousands have missed out, and because Congress has not extended the expanded CTC, millions of children have fallen back into poverty. To build a better future for children, families, and communities, Congress must renew the expanded CTC and ensure its benefits are easily accessible.

You must be logged in to post a comment.